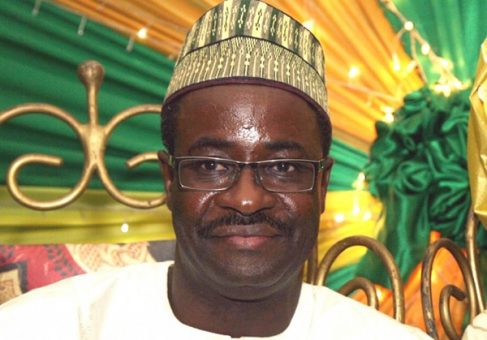

The Director-General of the Budget Office of the Federation, Tanimu Yakubu, has dismissed criticisms that Nigeria’s new tax laws would disproportionately burden low-income earners, describing such claims as “wrong notions and stage-managed arithmetic.”

Responding to a widely circulated essay critical of the reforms, Yakubu argued that labeling the policy as “Bola’s tax” ignores provisions designed to protect low-income workers. He said the critique relied on emotional framing rather than the actual structure of the tax schedule.

Yakubu explained that pension and health insurance contributions were wrongly presented as taxes, noting:

“A deduction is not a tax, and a contribution you own is not a levy you lose.”

He clarified that these deductions reduce taxable income, potentially lowering liability to zero for many earners. Using the example of a worker earning ₦75,000 per month, only ₦100,000 of the annual ₦900,000 income falls above the ₦800,000 tax-free threshold, meaning tax before deductions would be just ₦15,000 per year.

Yakubu also criticized the use of global poverty lines, such as the World Bank’s $4.20-a-day benchmark, warning that converting PPP measures directly into naira distorts the technical welfare metrics into political arguments.

Addressing the concern that “widening the tax base” would harm the poor, he emphasized that expanding the base targets non-compliant high earners, captures the digital and informal economy, and strengthens employer withholding, without affecting subsistence incomes.

On allegations of corruption or mismanagement, Yakubu noted these raise governance issues but do not undermine the tax schedule itself, adding that transparency, auditing, and enforcement should be strengthened.

“The outrage depends on omitting the very thresholds and concepts that make its conclusion collapse,” he said, insisting that the new tax structure explicitly protects low-income earners and that contrary claims are driven by narrative framing rather than arithmetic grounded in law.